‘Bad News Is Good News’ Rate Hopes Spur Equity Rally In July

7 min readfizkes/iStock through Getty Images

By Mark Barnes, PhD, and Christine Haggerty, Global Financial investment Study

After months of battering, global fairness markets enjoyed a reprieve in July, lifted by hopes that worsening economic alerts and slipping commodity charges could possibly give central banking companies, led by the Fed, some leeway to dial back again their tightening campaigns.

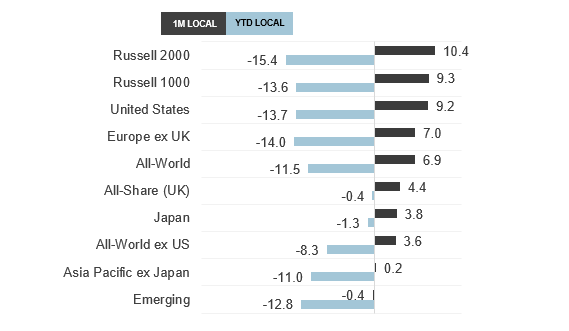

As we define in our most up-to-date GIR Functionality Insights report, any of this year’s worst-doing marketplaces this 12 months led the upsurge past thirty day period, most notably US and progress stocks. The badly crushed-down Russell 2000 and Russell 1000 indexes climbed 10.4% and 9.3%, respectively, drastically shaving their deep yr-to-date losses. The tale was much the exact for the FTSE Europe ex Uk.

All a few indexes outstripped the gains of the FTSE All-Globe and these of other important markets, specifically Japan and the British isles, which have held up ideal by way of this year’s punishing selloff.

World wide fairness current market returns – one thirty day period ended July 31, 2022 (TR, local forex %)

FTSE Russell. Facts as of July 31, 2022. Previous effectiveness is no assurance to future effects. Be sure to see the conclude for critical disclosures

Reading through the tea leaves

Possibility sentiment continues to be fragile, and one month does not a regime-modify make. (Without a doubt, in a ‘good news is bad news’ twist, the stronger-than-envisioned US career gains noted on Friday dampened anticipations for an previously Fed pivot.) Nevertheless, inspecting the most important influences at the rear of the July bounce-again offers some beneficial clues for navigating the uncertainties of continued central-lender tightening in the months in advance, as perfectly as for determining the possible lengthier-phrase winners and losers the moment financial tightening cycles in the long run conclusion.

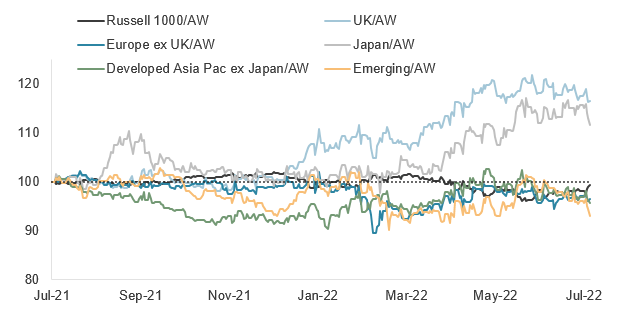

Inspite of their recent outperformance, US and European marketplaces ongoing to trail the global index for the calendar year by way of July conclusion, when the British isles and Japan held their YTD and 12-thirty day period leadership, irrespective of dropping ground to the environment index in July.

Regional index returns relative to FTSE All-Earth (rebased, TR, LC)

FTSE Russell. Details as of July 31, 2022. Earlier general performance is no ensure of long term results. You should see the conclude for vital legal disclosures

Advancement-stock exposures drive divergences

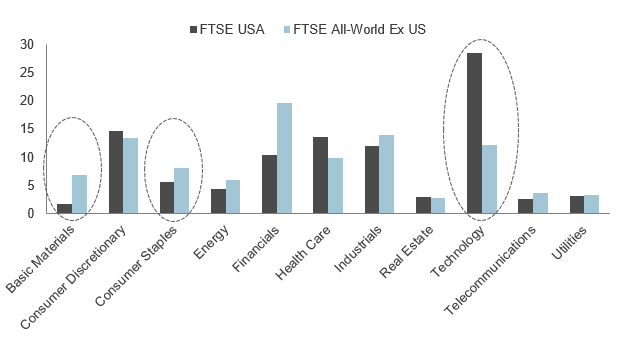

As we have created in earlier blog posts (in this article) and (listed here), significantly of the pain experienced by the US current market can be traced to its outsized publicity to the enormous unraveling of costly Technologies and other high-growth shares this 12 months, coinciding with the spike in interest prices and extreme possibility-off sentiment.

This and the US market’s smaller exposures to resilient defensive groups (Staples and Telecom) and to beneficiaries of the war-fueled commodity value boom (Components and Electricity) have contributed appreciably to US underperformance relative to world-wide peers. This was particularly legitimate as opposed to the British isles, with its negligible Tech body weight.

FTSE United states vs FTSE All-Entire world ex Usa sector weights (%) as of July 31, 2022

FTSE Russell. Primarily based on Market Classification Benchmark (ICB) details as of July 31, 2022. Earlier effectiveness is no warranty of future final results. Please see the conclude for critical legal disclosures.

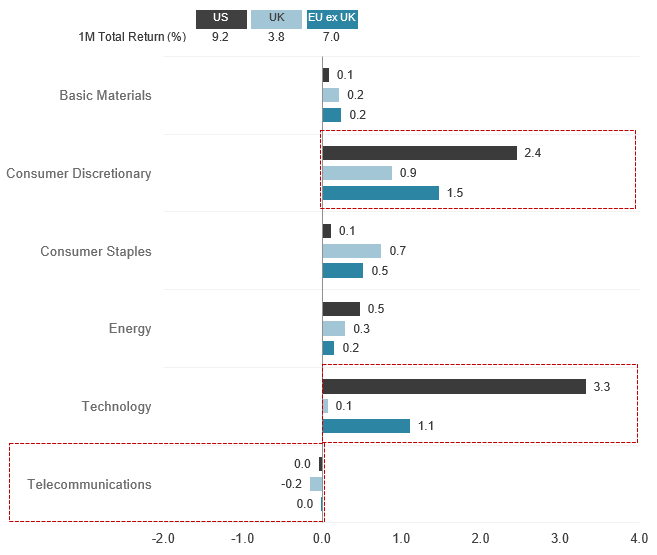

But hazard sentiment took a sharp U-convert in July, igniting an abrupt change in market place and sector leadership. Central financial institution rate-mountaineering resolve, even in the confront of plunging commodity selling prices and fast deteriorating economic details, despatched prolonged bond yields tumbling. Downtrodden growth shares enjoyed a powerful resurgence globally, although reflation beneficiaries and very first-fifty percent defensive winners lagged.

Business-weighted contributions to July 2022 returns – US, Uk, and Europe ex British isles

FTSE Russell. Primarily based on Industry Classification Benchmark (ICB) details as of July 31, 2022. Earlier effectiveness is no ensure of future final results. You should see the conclude for critical legal disclosures.

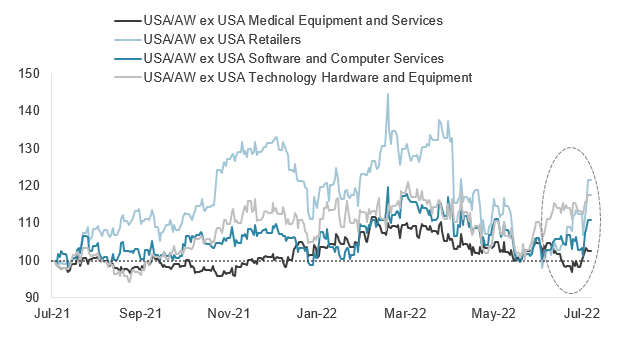

As proven beneath, bigger rebounds in sectors in just Know-how, Consumer Discretionary and Wellness Care led US outperformance over non-US peers last month.

FTSE United states sector returns relative to FTSE All-Entire world ex United states of america sector returns (rebased, TR, LC)

FTSE Russell. Dependent on Industry Classification Benchmark (ICB) data as of July 31, 2022. Earlier functionality is no assure of future success. Be sure to see the conclude for crucial lawful disclosures.

© 2022 London Stock Exchange Group plc and its applicable team undertakings (the “LSE Team”). The LSE Group involves (1) FTSE Global Limited (“FTSE”), (2) Frank Russell Business (“Russell”), (3) FTSE World wide Financial debt Money Marketplaces Inc. and FTSE Global Debt Capital Markets Confined (collectively, “FTSE Canada”), (4) FTSE Set Revenue Europe Limited (“FTSE FI Europe”), (5) FTSE Set Cash flow LLC (“FTSE FI”), (6) The Generate Reserve Inc (“YB”) and (7) Past Rankings S.A.S. (“BR”). All legal rights reserved.

FTSE Russell® is a trading identify of FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB and BR. “FTSE®”, “Russell®”, “FTSE Russell®”, “FTSE4Good®”, “ICB®”, “The Produce Book®”, “Further than Ratings®” and all other logos and assistance marks utilised herein (whether or not registered or unregistered) are trademarks and/or provider marks owned or licensed by the applicable member of the LSE Team or their respective licensors and are owned, or applied beneath licence, by FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB or BR. FTSE Worldwide Restricted is authorised and regulated by the Fiscal Carry out Authority as a benchmark administrator.

All info is provided for information purposes only. All info and knowledge contained in this publication is received by the LSE Group, from sources believed by it to be accurate and trusted. Simply because of the possibility of human and mechanical mistake as effectively as other variables, nonetheless, these kinds of information and info is furnished “as is” devoid of guarantee of any variety. No member of the LSE Team nor their respective administrators, officers, workers, partners or licensors make any assert, prediction, warranty or representation in anyway, expressly or impliedly, possibly as to the precision, timeliness, completeness, merchantability of any info or of final results to be received from the use of FTSE Russell items, together with but not minimal to indexes, details and analytics, or the health and fitness or suitability of the FTSE Russell goods for any unique purpose to which they may be place. Any representation of historical details accessible via FTSE Russell items is offered for data applications only and is not a trusted indicator of potential overall performance.

No obligation or liability can be recognized by any member of the LSE Group nor their respective administrators, officers, personnel, companions or licensors for (A) any reduction or harm in full or in element triggered by, ensuing from, or relating to any error (negligent or otherwise) or other circumstance concerned in procuring, amassing, compiling, interpreting, analysing, modifying, transcribing, transmitting, communicating or providing any these kinds of information or knowledge or from use of this doc or back links to this doc or (B) any immediate, oblique, particular, consequential or incidental damages whatsoever, even if any member of the LSE Group is suggested in advance of the chance of this sort of damages, resulting from the use of, or incapacity to use, such facts.

No member of the LSE Group nor their respective administrators, officers, staff, partners or licensors deliver financial commitment information and practically nothing in this doc must be taken as constituting money or investment decision advice. No member of the LSE Team nor their respective administrators, officers, staff, associates or licensors make any representation pertaining to the advisability of investing in any asset or regardless of whether these types of expense creates any authorized or compliance hazards for the investor. A determination to devote in any these types of asset should really not be built in reliance on any information herein. Indexes are not able to be invested in immediately. Inclusion of an asset in an index is not a suggestion to acquire, promote or maintain that asset nor affirmation that any individual investor might lawfully buy, market or keep the asset or an index that contains the asset. The normal information and facts contained in this publication should not be acted on without the need of acquiring precise lawful, tax, and expense assistance from a accredited skilled.

Past efficiency is no guarantee of upcoming effects. Charts and graphs are furnished for illustrative purposes only. Index returns revealed might not represent the success of the precise buying and selling of investable assets. Specified returns shown may reflect again-examined overall performance. All efficiency introduced prior to the index inception day is again-examined overall performance. Back again-analyzed effectiveness is not genuine effectiveness, but is hypothetical. The again-exam calculations are primarily based on the similar methodology that was in outcome when the index was officially launched. Nevertheless, again-examined knowledge could reflect the software of the index methodology with the advantage of hindsight, and the historic calculations of an index might improve from month to thirty day period based on revisions to the fundamental economic information utilized in the calculation of the index.

This document may well include ahead-on the lookout assessments. These are based mostly on a selection of assumptions regarding upcoming conditions that finally may possibly verify to be inaccurate. Such ahead-searching assessments are subject matter to risks and uncertainties and may perhaps be affected by several components that may possibly lead to true outcomes to vary materially. No member of the LSE Team nor their licensors suppose any duty to and do not undertake to update forward-seeking assessments.

No aspect of this details may be reproduced, stored in a retrieval system or transmitted in any kind or by any means, digital, mechanical, photocopying, recording or normally, with out prior published permission of the relevant member of the LSE Group. Use and distribution of the LSE Group facts involves a licence from FTSE, Russell, FTSE Canada, FTSE FI, FTSE FI Europe, YB, BR and/or their respective licensors.

Editor’s Note: The summary bullets for this report have been chosen by Trying to find Alpha editors.